The 9-Minute Rule for Eb5 Investment Immigration

The 9-Minute Rule for Eb5 Investment Immigration

Blog Article

The 25-Second Trick For Eb5 Investment Immigration

Table of ContentsEb5 Investment Immigration Fundamentals ExplainedEb5 Investment Immigration for BeginnersThe Main Principles Of Eb5 Investment Immigration The Definitive Guide for Eb5 Investment ImmigrationNot known Factual Statements About Eb5 Investment Immigration

While we aim to offer accurate and updated material, it must not be taken into consideration legal recommendations. Migration regulations and regulations go through change, and specific scenarios can vary extensively. For personalized advice and lawful suggestions regarding your specific immigration circumstance, we highly suggest seeking advice from a qualified migration attorney that can supply you with tailored assistance and make sure compliance with existing legislations and policies.

Citizenship, with financial investment. Presently, since March 15, 2022, the quantity of financial investment is $800,000 (in Targeted Employment Locations and Country Areas) and $1,050,000 in other places (non-TEA zones). Congress has accepted these amounts for the next five years beginning March 15, 2022.

To get the EB-5 Visa, Financiers have to produce 10 full time U.S. tasks within 2 years from the day of their full financial investment. EB5 Investment Immigration. This EB-5 Visa Demand ensures that investments add straight to the U.S. work market. This applies whether the tasks are developed straight by the commercial business or indirectly under sponsorship of a designated EB-5 Regional Center like EB5 United

The Ultimate Guide To Eb5 Investment Immigration

These jobs are figured out with versions that make use of inputs such as growth prices (e.g., building and construction and tools costs) or annual revenues generated by continuous procedures. On the other hand, under the standalone, or direct, EB-5 Program, only straight, permanent W-2 worker placements within the business may be counted. An essential risk of depending only on straight staff members is that staff reductions as a result of market problems could lead to inadequate full-time settings, possibly causing USCIS rejection of the capitalist's request if the task development requirement is not satisfied.

The financial version then projects the variety of direct work the brand-new business is likely to produce based upon its awaited profits. Indirect jobs calculated through economic versions refers to work produced in markets that provide the items or solutions to the organization straight associated with the job. These work are created as an outcome of the raised demand for products, materials, or services that support the company's procedures.

Fascination About Eb5 Investment Immigration

An employment-based fifth preference category (EB-5) financial investment visa provides my company an approach of ending up being a long-term united state homeowner for foreign nationals wishing to spend capital in the USA. In order to request this permit, a foreign financier needs to spend $1.8 million (or $900,000 in a Regional Center within a "Targeted Employment Area") and create or preserve a minimum of 10 permanent tasks for USA employees (leaving out the capitalist and their prompt family).

Today, 95% of all EB-5 funding is raised and spent by Regional Centers. In several regions, EB-5 investments have loaded the financing void, offering a brand-new, vital source of funding for regional economic advancement tasks that rejuvenate neighborhoods, produce and support tasks, infrastructure, and services.

Eb5 Investment Immigration for Dummies

employees. Furthermore, the Congressional Spending Plan Office (CBO) scored the program as profits neutral, with administrative costs spent for by candidate costs. EB5 Investment Immigration. Greater than 25 countries, including Australia and the United Kingdom, usage similar programs to attract foreign investments. The American program is much more rigorous than several others, needing substantial danger for capitalists in terms of both their economic investment and migration condition.

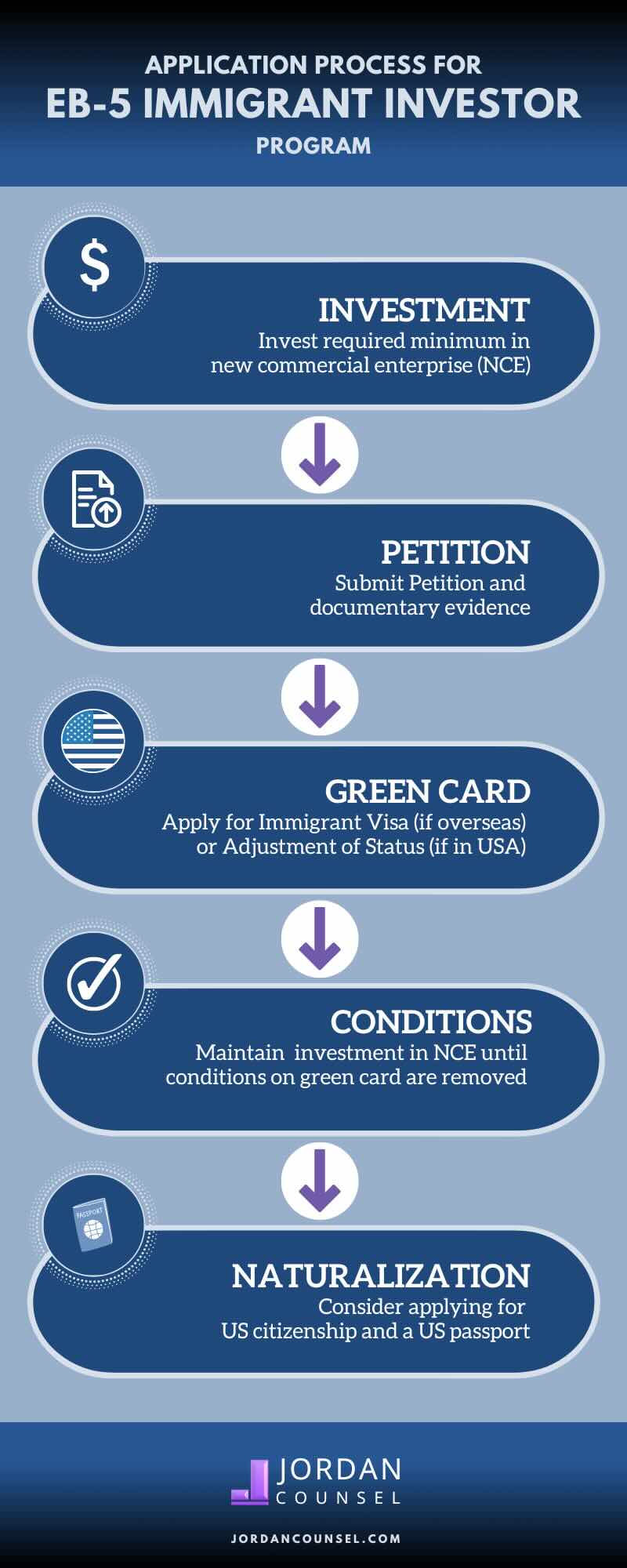

Families and individuals who seek to move to the United States on a permanent basis can use for this post the EB-5 Immigrant Investor Program. The United States Citizenship and Immigration Services (U.S.C.I.S.) established out various needs to acquire irreversible residency with the EB-5 visa program.: The initial step is to discover a certifying investment chance.

Once the opportunity has been identified, the capitalist needs to make the financial investment and submit an I-526 request to the united state Citizenship and Immigration Services (USCIS). This petition has to consist of proof of the financial investment, such as financial institution statements, acquisition agreements, and company strategies. The USCIS will evaluate the I-526 application and either accept it or demand extra proof.

Unknown Facts About Eb5 Investment Immigration

The investor must make an application for conditional residency by submitting an I-485 application. This petition should be submitted within six months of the I-526 authorization and must consist of proof that the investment was made which it has produced at the very least 10 permanent tasks for united state employees. The USCIS will certainly review the I-485 petition and either accept it or request additional evidence.

Report this page